There must be many out there questioning where all the promised disruption is. Sometimes it seems like a slow burning fuse.

Everyone seems remarkably focused on disruption, and new business models, that it’s a bit like peering at the dawn waiting for the impending attack. Anyone who’s actually stared at the dawn light knows that dawn isn’t punctual, and can take a good time to come and go. And if you’re wide eyed and staring during the time, then you’ll likely miss other important things happening around you.

However, we’ve been told every good business plan / strategic plan, should be cognisant of the digitial disruption, and in the financial sector these are the fintechs, machine learning, robo-advice and cloud based solutions. These are pretty much the same things that are pushed out to Australian accountants for compliance risks.

Part of reducing the risks is to remove variability in processes, and to lock in standardization as a norm. Once standardization is under control, then quality processes can be introduced. Electronic working papers are one example.

One advantage of standardization and quality processes is that new employees can be brought on board, and up to speed, fairly quickly. The big downside is the requirement to continually maintain the systems. There is questionable value in maintaining systems in areas of low revenue streams (through low volumes of work), or areas of low profitability with potentially shrinking margins (yes, Compliance). In highly competitive areas such as Australian tax compliance, then it’s not just necessary to maintain, but also to improve processes in order to keep ahead of the competition.

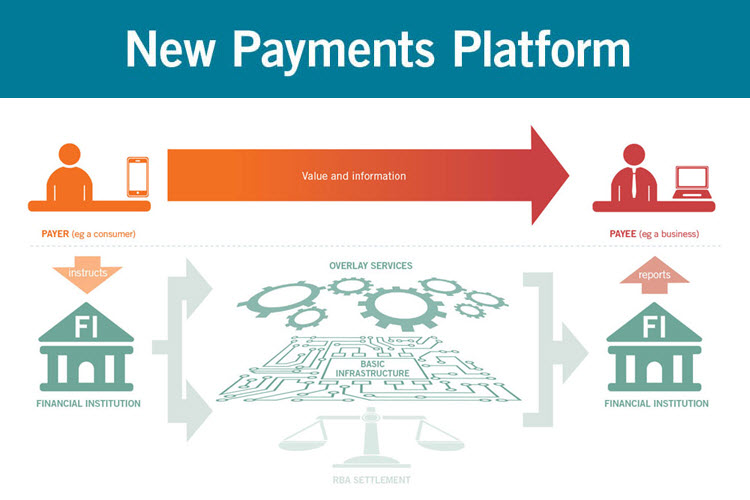

So as we’re being told, disruption is here, and it’s up to the leaders of the organization to take the hard decision to invest the time and resources to invest in unproven new service lines. New service lines must consider client real time data, and that data should be data rich consisting not just financial data, but an ambit of other variables.

It must be that the accountant is in pole position to make massive inroads into these new service lines. But if the accountant’s don’t seize the initiative, then other advisors will step in to enjoy a piece of that pie. Those other advisors can be financial planners, lawyers, and business coaches.

So, the disruption is happening, albeit slowly, and it’s up to the leaders in the accounting firms to not only take charge of efficiencies in key areas like compliance, but also invest in future service lines to protect revenue streams.