Well this is the year when the NPP is due to be launched.

Hailed as a game changer in the banking system that has the potential to transform how you pay for everything.

Certainly this is a much needed system. Australians have certainly embraced electronic payments, but the payments systems behind electronic payments is certainly dated.

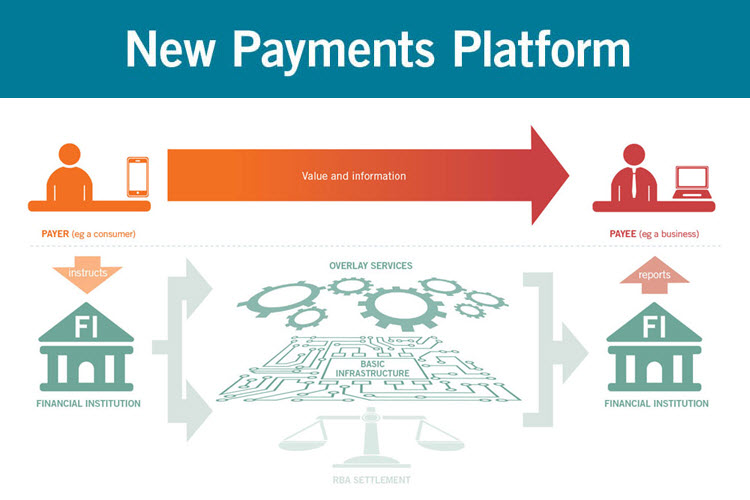

The new piece of infrastructure goes by the name of the New Payments Platform (NPP for short). This initiative came from the RBA, who pushed the banks to develop and fund the NPP.

In 2015 a contract was signed with SWIFT to design, build and operate the platform. SWIFT is known as the network that enables financial institutions worldwide to send and receive information about financial transactions in a secure, standardized and reliable environment. So we can expect implementation to happen.

You’ll no longer have to remember complex BSB’s. NPP customers will be able to enter up to 280 characters as well as link to documents when making payments.

And payments should happen pretty much instantaneously 24/7 and not the up to 3 days that it takes at the moment. 24/7 means that settlements and payments will move between banks “exchange settlement accounts” (ESA) in real time.

Apart from the BSB and timing issue, the big changes come from having an “identifier” and the apps that will arise from this new concept. You can expect more time savings apps and seamless paying for things. The infrastructure will also support ‘overlay’ services that can be independently developed to offer consumers innovative and ground-breaking payment experiences.

You can also expect that clients can move banks more easily without notifying their customers/suppliers of changes in banking details. The “identifier” stays the same, but the underlying bank account changes. So you can expect more competition in the banking industry.

More information about the new payments platform can be found on the Australian Payments Clearing Association APCA website. And information on what you need to know about Australia’s new payments platform is available here.

This is certainly a revolutionary change in payments about to hit the banking industry this year, and Australian accountants should be all over how these changes will impact their clients.