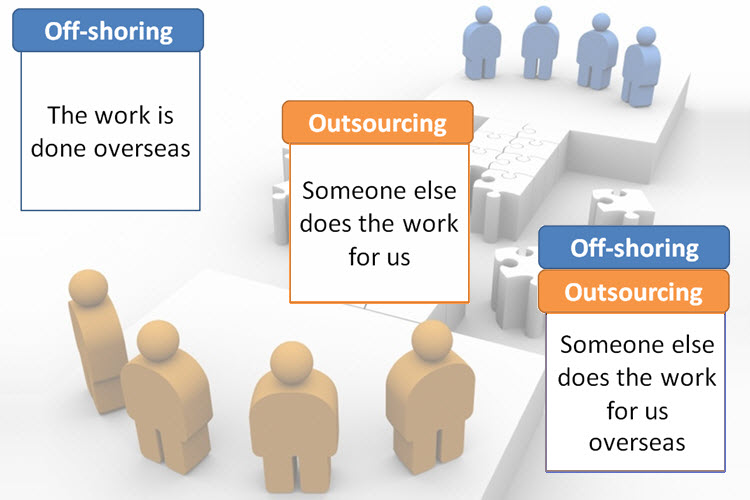

The CPA Australia Outsourcing Guide provides a comprehensive checklist of what should be included in an outsourcing agreement.

There are 15 main items that should be covered in an outsourcing agreement. This post will present the first 7 items as below

Scope and performance of services

- Detailed description of the type and scope of outsourced services to be provided

- where a resource is provided, details of that resource

- Details of how the outsourced service will be performed

- actions and responsibilities of the parties

- inputs to be used

- systems to be used to complete the work

- location of the systems to be used

- access to the systems to be used

- software to be used to complete the work

- anticipated outputs including reports e.g. BAS / Accounts / Tax Return

- Accessibility

- if Cloud facilities are not being used how will you access your files?

Dates of agreement

- Effective date for the commencement and conclusion of agreement

- Extensions of the agreement

- Commencement date for services if not the same as the effective date

Variation and termination

- How changes in service requests will be conducted

- changes in the pricing model

- changes in the process

- changes in the services to be provided

- changes to the resource allocation

Provisions for termination

- Conditions for terminating the agreement under normal circumstances

- Conditions for terminating the agreement under other circumstances e.g. non-performance

- Other conditions e.g. a change in control or management with either party

- Responsibilities of both parties upon termination

- The format, form and quantity of data, in printed or electronic form, to be provided by the OSP

Pricing and fee structure

- The pricing model

- any initial fee (also known as a set-up fee) for the start of the service and scope of that fee

- any deposits or security bonds

- ongoing fees and disbursements associated with all work to be performed under the agreement and the scope of those fees e.g. fixed “seat” fees, variable “employee” fees, office supplies, printing, phone charges and travel expenses

- employee on costs e.g. health care card, rice subsidy, transport allowance, 13th month bonus etc.

- employee entitlements e.g. annual leave, birthday leave, sick leave, public holidays etc.

- surcharges for work

- miscellaneous fees or expenses

- Consideration of foreign exchange

- Procedure for reimbursement of expenses and miscellaneous costs

- Fee variations

- Fee increases

- notice period for fee increases

- Overseas taxation obligations, including any GST considerations

Payment terms

- The payment terms

- Deposits required, including variations of deposits

- Late payment terms and fees

- SLAs – Service Level Agreements and performance

- Required service levels and performance requirements

- Contract termination and disengagement terms

- Contract reward and penalty considerations

Representations and warranties

- OSP’s responsibility for the accuracy and completeness of the information supplied to the member

- OSP’s responsibility for timely, consistent, professional and high quality level of service

- Who retains ultimate responsibility for all work delivered

- Period of warranty of work

- Responsibilities for rework in and outside the warranty period

- Variations to fees for work as a result of warranty

Now you have gone through half of the items included an outsourcing agreement. Next week, we will post on the rest so that you can get the complete overview of how an outsourcing agreement should be made.