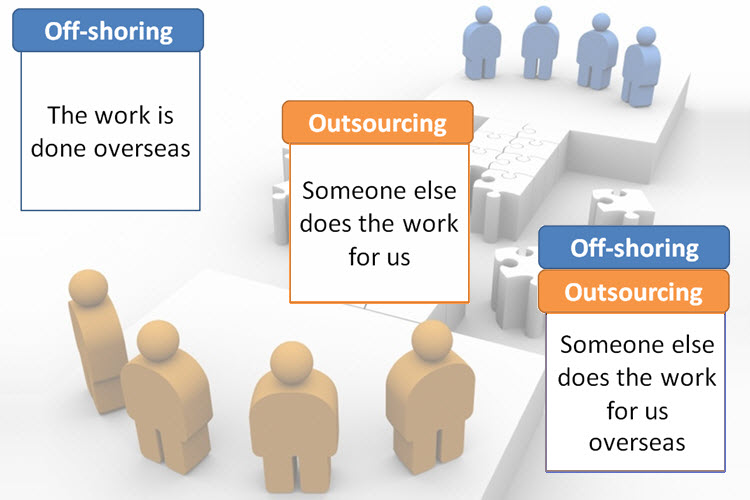

With the competition for offshoring and outsourcing heating up, we thought it might be a good time to look at the future of offshoring and outsourcing.

In looking at the firm of the future, there are several obvious recent trends that will impact the future of work completed offshore.

Amongst these trends are:

- Mobility of workforce. Previously many foreign students came to Australia to study and stayed. Now there are many opportunities to complete compliance work offshore, and Australian educated/experienced staff are commanding a high premium

- Mobility of industry and university training facilities. Previously you had to travel to Australia to undertake University or Tafe training. For several years there have been many strategic alliances between Australia’s leading universities and offshore universities, with Australian curriculums being taught overseas

- Changes in delivery methods of training. With digitization it’s possible now to realistically consider distance learning. This significantly brings down the costs of training.

- Mobility of professional organisations. Australian professional organisations such as the Australian CPA have recognised the marketability of their brand. They’ve setup offices in several overseas destinations.

- Ability to move Australian experienced staff overseas on secondments. The world is a smaller place. It’s easier to send resources overseas these days compared to last century when Australian’s seldom travelled overseas except on the big Europe trip (apart from Bali!!)

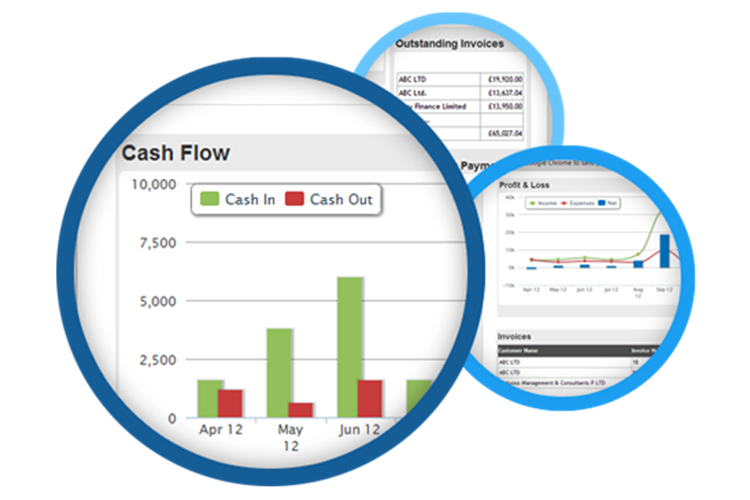

- The Cloud. This has to be a big game changer. Work can be done anywhere anytime

- Ongoing modifications to cloud software. Another game changer. Not only is software getting cleverer, but the software releases are coming thick and fast. It’s easier to update a piece of software on the cloud, compared to desktop.

- Automation. The elephant in the accounting room. Who knows. Expect something in the next 1-2 years to identify if this is really a game changer.

- Australians are expensive. There’s a continuing understanding that Australian labour force is expensive.

- Your clients are looking overseas for resources. Your clients can access the web to answer questions as quick as you can. This leads to ongoing pricing pressures for simple compliance work.

So, we believe that there will be an ongoing impact on Australian offshore labour forces as a result of these trends.

Stay tuned next week while we expand out on what these trends mean for Australian compliance.