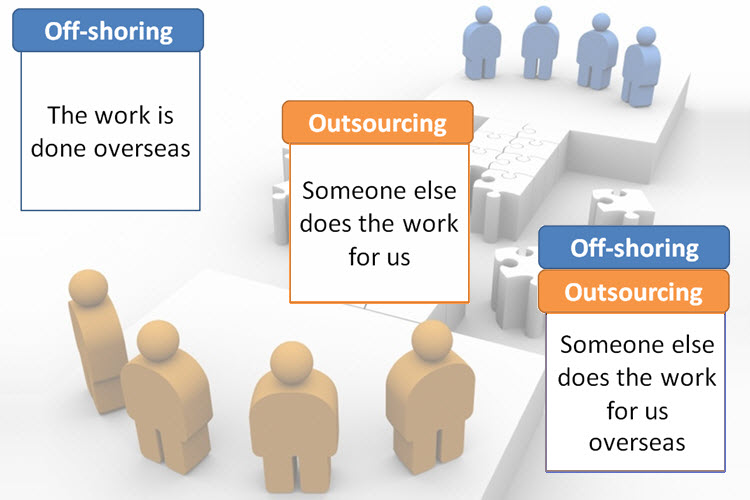

Outsourcing has been in the news recently, and online comments on what Australian accountants are thinking about outsourcing are quite enlightening.

So what are they actually thinking?

Trolling through some Australian online sites, we’ve found some interesting comments. Australian accountants are:

- concerned about the impact of outsourcing

- have seen poor work quality

- Have concerns that the foreign worker does not have an adequate understanding of our actual environment since they have never even been here or worked here. (Particularly relevant when you are hiring an offshore worker, as opposed to a trained outsourced worker)

- Worried about the long term impact of Outsourcing on the Accounting profession

- Worried about how junior workers are going to get jobs / training

- Worried about where middle managers are going to come from in the future. Concerned at the scarcity of any senior accountants with the local knowledge and experience.

- Worried whether the Australian compliance employee will become obsolete if all the work is outsourced overseas

- Worried about how to compete when overseas workers are competing directly with accounting firm clients. Some indicate there is no way Accountants in Australia (talking about qualified ones who are producing accurate and professional work ) can compete with the overseas ones who try and convince people they can do the work professionally

- Worried about security

- Concerned at tax system and appropriate deductions being claimed

- Have experienced a lack of basic accounting fundamentals and accounts were not properly reconciled

- Some put forward the need to invest in young Australian accountants and train our young people to become our future senior accountants

- Concerns on identify theft

- Worried about where the profit should be split when work is outsourced. Should it be shared with the client, when the risk is borne by the firm? Some complain the owners pay themselves big salaries and bonuses out of the profits.

- Feel that competition is great and competing with Australian firms is OK but feel there is no level playing field against offshoring and outsourcing. “Globalization sucks” as one person elegantly put it.

- Worry how to hire Australian workers with the large overheads: Australian workers just have a greater wage cost per hour but other costs such as super, workers comp insurance , a host of over the top regulation e.g. anti bullying laws and so on that has to be complied with at cost.

- On top of the costs of Australian workers, many comment at the “terrible attitude of the person. You ask someone to do something for you and all they want to do is argue with you. “

- And then, there’s the problem with mobile phones. You ask them to not keep looking at the phone while they work and then you get told you’re badgering them.

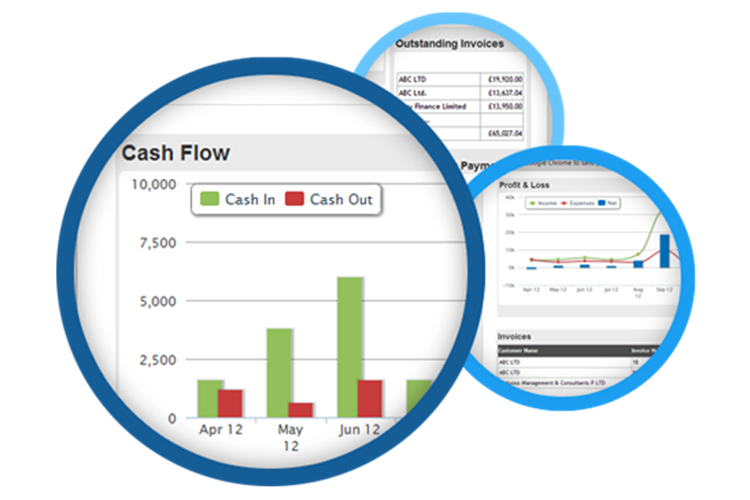

- Commodification: It must be becoming clearer that preparation of a basic set of accounts and associated work-papers has become a ‘commodity’ service particularly in the eyes of most business owners, SME’s in particular. Most never look at the accounts their Accountant proudly delivers to them.

- Some rave about outsourced work. “I have seen some of the accounts work done by overseas Accountants and it was excellent.”

- Some accountants comment “If Practitioners continue to hold on to the old style Practice model (doing the accounts work in-house) they will continue to face cost pressures.”

- And see the preparation of a set of accounts becoming a ‘loss leader’ product for forward thinking Practices just to offer the ‘added value/high value’ work that many business owners are looking for”

Does any of this resonate with you?

Interested in outsourcing. Drop us a line to chat more about how we can help.