2025 is just around the corner, and for pretty much all of us in Australia we’ll be somehow engaged in work or play. Most of the present factors that we see in our daily news will continue to affect work, life and play. Australia will have an increasing need for infrastructure to remain competitive, there will be an ageing population putting strain on health and aged-care, and it’s likely that there will be quite a few current trends that have major impacts on our life.

KPMG has just released a report “Tax 2025: People, the economy and the future of tax” which opens the discussion on the longer view on what the practice of tax will be like in 2025. The report communicates in several sections different factors which will impact future life and future tax in 2025.

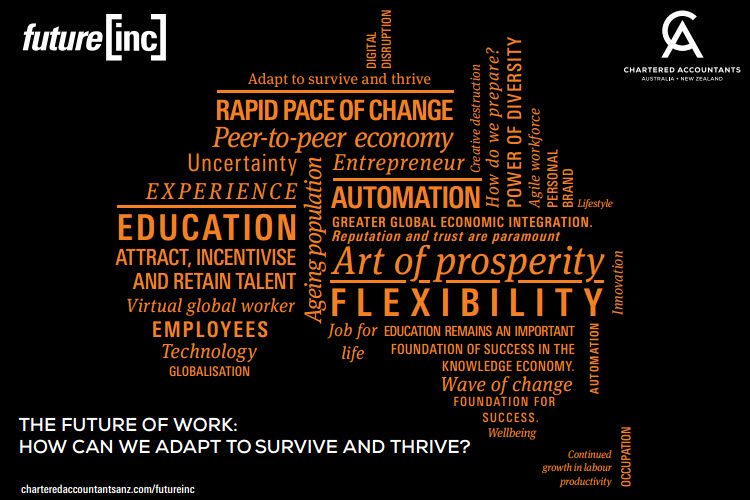

Enframing the future looks at the future being here (though only for a small number of us at present), indicating that the past is no basis for predicting the future (change is now a constant!), with 2025 belonging to those who embrace change and create the future as opposed to waiting to react to the future.

Technology will play a massive part in 2025. There will be massive use of pocket supercomputers and massive storage, objects people and computers will be linked, 3-D printing may improve, bioprinting of spare parts for humans, driverless cars, artificial intelligence, blockchains and cities with energy/traffic co-ordinated by computers.

Values will also be affected. The concept of global cities will emerge, with power in the hands of distributed networks (bottom up rather than top down), work will fragment into segments as life expands out towards 100, work will be more flexible, we’ll see the rise of the entrepreneurs.

For our economy, there will be social dislocation, Asia will impact Australia through the massive middle class, sharing economies will allow lower traditional employment, new market creators have a winner takes all ability. Offshoring from an educated middle class located in Asia will have massive impact on Australian compliance. It is likely that the efficiencies from the use of artificial intelligence and automation will lead to greater outsourcing of the compliance function. This will free-up personnel for greater value-added activities.

In terms of the future tax base, international company tax rates will stabilize to around 17-25% (in line with Hong Kong and Singapore), with complexities in transfer pricing and removal of tax havens leading to global safe harbours (again thing Hong Kong and Singapore), GST consumption tax will diminish, new withholding taxes will arise, and land taxes will increase. We will see an increase in user based charges as opposed to blanket increases in taxes on the tax base.

For compliance and the administration of tax, there will be the ability for the ATO audit teams to directly access cloud GL’s, a drive to simplicity resulting in many tax agents moving out of the industry and only higher value-add tax agents remaining, and lower margins. On the domestic level, the tax agent market is likely to shrink dramatically. This will occur largely because of the additional effort that the Australian Tax Office (ATO) will put into the preparation and lodgment of personal income tax returns through ATO pre-filling, and lodgment through smartphone applications. Businesses and more complex individuals will still require tax agents, but their survival will be based on providing significant value add. The technological changes are likely to mean few mid-skilled jobs will be required.

Whilst 2025 is a decade away, it is clear we can expect compliance work to be massively affected in upcoming years. The ability for accountants to focus on value-add is now more critical than ever.